FICA taxes also go to Medicare programs that fund older and certain disabled Americans’ health care costs. When you’re old enough, FICA funds collected from those still in the workforce will pay your benefits. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange https://kelleysbookkeeping.com/ for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Those who are self-employed must pay both portions, for a total tax rate of 2.9%. Elective contributions to a qualified retirement plan are also subject to FICA. Employer-paid accident or health insurance premiums for an employee, including the employee’s spouse and dependents, are not wages and are not included in FICA. Health Savings Account (HSA) contributions made by the employer are also not considered wages. The wage limit is inflation-indexed annually and can be found in IRS Publication 15 for most employees, or Publication 51 for agricultural workers. According to IRS Publication 15, wages subject to FICA include all income received for services performed, unless specifically excluded.

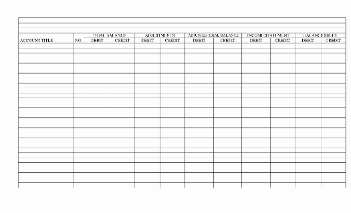

How to calculate FICA payroll tax

The wage bracket method uses referencing tables to determine withholding for employees with salaries under $100,000; it is the simpler method of the two because no additional calculations are required. The percentage method is used by employers that outsource their payroll systems or use automatic payroll programs to calculate withholdings. To calculate net pay, deduct FICA tax; federal, state, and local income taxes; and health insurance from the employee’s gross pay. Gross taxable wages describes the money your employee earns that is subject to income tax withholding and/or FICA tax.

- The amount of payroll tax taken out of a paycheck depends on your gross pay.

- Your employer withholds 1.45% of your gross income from your paycheck.

- These are some of the reasons why many employers choose to use automated payroll software, namely NetSuite’s SuitePeople Payroll.

- Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

- Gross taxable wages describes the money your employee earns that is subject to income tax withholding and/or FICA tax.

- For information on how to compute the claim of right deduction, see “Repayment of Claim of Right Income” and “Repayment of Claim of Right Worksheet” located in the North Carolina Individual Income Tax Instructions.

For example, when you look at your paycheck you might see an amount deducted for your company’s health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax. Some deductions are “post-tax”, like Roth 401(k), and are deducted after being taxed. The FICA tax (Federal Insurance Contribution Act) tax is an employee payroll tax that funds Social Security benefits and Medicare health insurance.

Stay up to date on the latest payroll tips and training

Social Security tax rates are determined by law each year and apply to both employees and employers. Some employees may want to claim an exemption from federal income tax withholding. This exemption has nothing to do with FICA taxes; you must still withhold FICA tax from each paycheck for all employees. Businesses that offer health insurance, dental insurance, retirement savings plans and other benefits often share the cost with their employees and withhold it from their pay. Depending on the type of benefit and the regulations that apply to it, the deduction may be pretax or post-tax. Pretax is more advantageous to employees because it lowers the individual’s taxable income.

Those who are self-employed are liable for the full 12.4%. Employers have to withhold taxes — including FICA taxes — from employee paychecks because taxes are a pay-as-you-go arrangement in the United How Do I Calculate The Amount Of Fica Tax Deductions? States. When you earn money, the IRS wants its cut as soon as possible. A withholding tax is an income tax that a payer (typically an employer) remits on a payee’s behalf (typically an employee).

State Income Tax Withholding

Select your state from the list below to see its hourly paycheck calculator. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances.

As with federal payroll tax, part of this tax is employer-paid, and part is employee-paid. Keep in mind that “employee-paid” just means that you, the employer, withhold a certain amount from your employee’s paycheck and then remit it as part of your payroll taxes. Generally, a salaried employee earns the same amount in gross wages each pay period (unless they’re eligible for overtime pay).

What is Pay-As-You-Go Workers’ Compensation Insurance?

So you can claim it regardless of whether you’re itemizing your deductions or taking the standard deduction. Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare. If you own a business, you’re responsible for paying Social Security and Medicare taxes, too.

In 1982, 90 percent of earnings were subject to the Social Security tax, but by 2017 the share had decreased to 84 percent. The limit on annual earnings subject to Social Security taxes is referred to as the taxable maximum or the Social Security tax cap. For 2023, that maximum is set at $160,200, an increase of $13,200 from last year. When the tax dedicated to Social Security was first implemented, it was capped by statute at the first $3,000 of earnings (which would be equivalent to about $56,000 in 2021 dollars).

What Changes Could be Made to the Tax Cap?

Use each employee’s W-4 form and the federal income tax withholding tables in IRS Publication 15 to figure out how much the employee owes in federal income taxes. Under federal law, if a taxpayer is required to repay an amount previously included in the federal return in an earlier year, the taxpayer may be able to deduct the amount repaid or take a tax credit. The amount of the repayment determines the options available to the taxpayer. For North Carolina tax purposes, a taxpayer is allowed a deduction for the repayment to the extent the repayment is not deducted in arriving at the taxpayer’s adjusted gross income in the current taxable year. If the repayment is more than $3,000, the deduction is the amount of the repayment. If the repayment is $3,000 or less, the deduction is the amount of repayment less 2% of adjusted gross income.

In this guide, we’ll show you how to calculate employer payroll taxes (the taxes you, as the employer, will pay) as well as how much employee tax to remit to the government. To determine each employee’s FICA tax liability, multiply their gross wages by 7.65%, as seen below. These are the amounts you withhold from employee wages and send to the IRS. Unlike FICA tax, employers and employees do not share the responsibility of self-employment tax. Instead, the employer is responsible for paying the total 15.3% toward Social Security and Medicare taxes. Self-employment tax is also known as the Self-Employment Contributions Act (SECA) tax.